Everybody has had to save money at some point in their life, from buying a house, a car, a holiday or just savings for a rainy day. Saving can be tough when we have commitments to monthly bills, travel expenses, grocery shopping and much more, but saving a little bit where you can, can really add up each month. With the decrease in savings rates in March 2020 due to Covid, it’s harder for people to save when they see very little interest on their money and because some people lost their jobs or only got paid 80% of their wages. Raisin put together a great graph to show the average savings of people in the UK, which is £9,633.30. When you look at it, the savings figure is low compared to the cost of living. The cost of living is high in the UK, so that means people can’t save as much, but we’ve put together this handy article to get you started on your savings journey!

Our typical Highstreet banks that we’re used to haven’t made saving easy. They have a very outdated model of banking that isn’t user friendly and not clear for us to see everything coming in and out of an account. We’re now moving to online banks, called Fintechs, like Starling Bank and Monzo Bank; the two biggest competitors in the Fintech market now. Fintech banks are online banks that have no branches. Most of these banks have customer service support 24/7 via live chat, call or email depending on their business model.

We’re going to discover some ways in which Fintech banks can help you save and manage your spending with a few simple features:

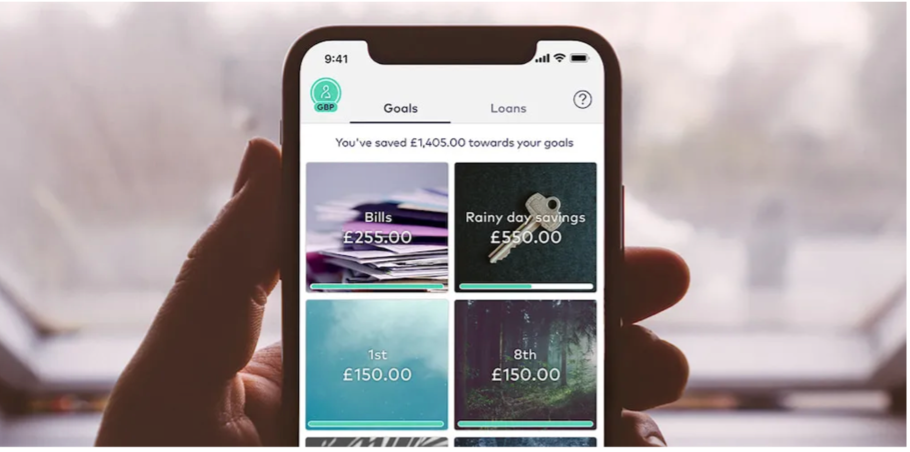

SAVINGS POTS/SPACES

Fintech banks don’t call them savings accounts anymore, they call them ‘savings pots’ or ‘spaces’ depending on who you bank with. These pots allow you to set money aside from your main account balance, but sometimes they don’t pay interest on these pots. Some Fintech banks are partnered with other big banks that focus on savings as their main product. They come together to create one suitable for the Fintech bank.

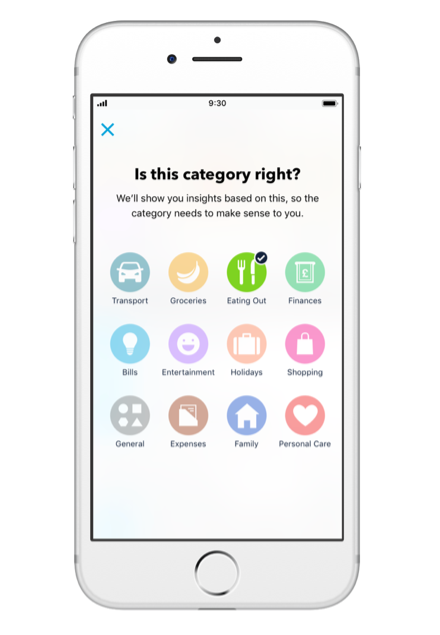

SPENDING CATEGORIES

Fintech banks are also very well known for their spending categories. When you spend money, whether that be shopping, a bill or bank transfer, the app will allow you to categorise your payments to see how much you spend in that category each month. Some Fintech banks will show you a monthly summary to show what you spent and how you can improve if it’s increased from the previous month. It’s very easy to spend money on things we don’t need, so be particularly careful with this.

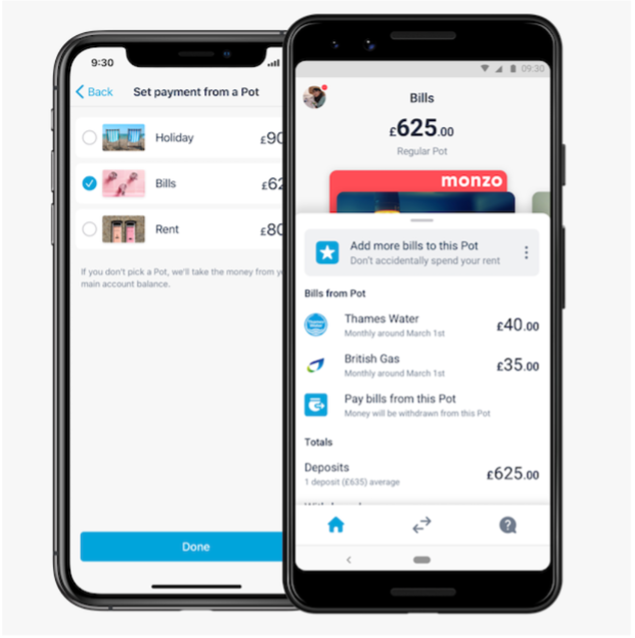

SPACES FOR BILLS

Earlier on we spoke about banks having ‘pots’ or ‘spaces’ to save money, they have now introduced having bills paid from these areas to allow people to separate their main spending away from their bills. Similar in a sense to Highstreet banks where you had to open a whole separate account, Fintechs don’t require this. These are so handy when you get paid, you can set the money aside and the bills will come out as normal.

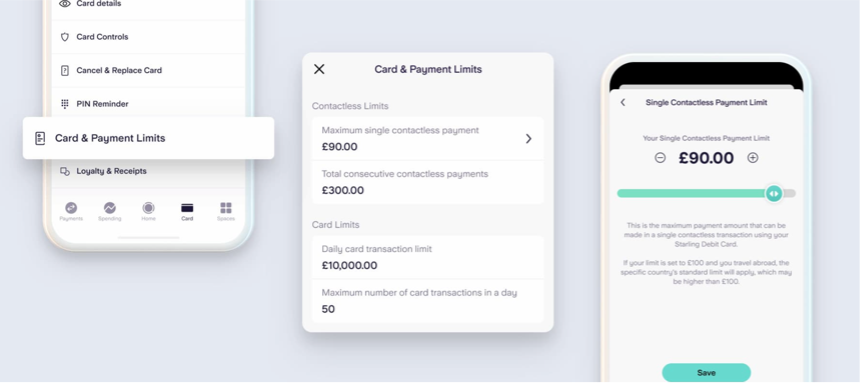

CONTACTLESS PAYMENTS

We all know that the banking industry has made the decision to increase contactless payments from £45 to £100. All banks have accepted the increase and some people online aren’t very happy they can’t control this limit. Starling Bank is the only bank in the UK that has implemented a feature that allows customers to set their own contactless limit, giving them control over their money.

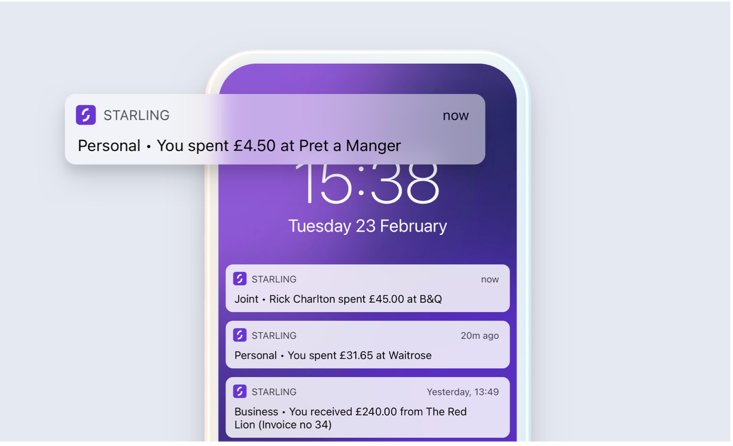

INSTANT NOTIFICATIONS

Finally, we have instant notifications. As soon as you tap your card or click ‘pay’ online a notification will pop up alerting you that you’ve spent money. Some banks will have a small line under that saying how much you’ve spent for the day too! Although this is a standard for Fintech banks, Highstreet Banks like HSBC have not implemented this feature.

Follow us on Instagram to tell us what you think.